Life insurance helps relieve some of the financial burdens from your family when you pass away. It can be overwhelming planning for the end of your life, which is why a Mississippi independent insurance agent can help.

Before you settle into a Mississippi life insurance policy, an agent can review your needs and provide information about different policies and what will fit you best.

What Is Life Insurance?

Life insurance is a type of insurance policy that you purchase while you're alive that pays a lump sum of money to someone of your choosing when you pass away. This person is referred to as a beneficiary.

When you purchase life insurance, you'll determine the amount of money you'd like a beneficiary to get paid. You then pay a monthly or yearly premium in order to maintain the insurance policy.

There are two main life insurance policies

- Term life insurance: Covers you for a specific amount of time, usually 10, 20, or 30 years. Should you pass away within the allotted time frame, your beneficiary will receive your payout.

- Whole life insurance Covers you for your entire life and includes a savings account that you can use to accrue cash.

"For more people a term life insurance plan is the best option," explained insurance expert Paul Martin. "Term life insurance tends to be more affordable. People think that term insurance gets more expensive as you get older, but that's not true."

What Does Mississippi Life Insurance Cover?

Life insurance can be used to pay for anything your beneficiary needs after you die, but it is commonly calculated to pay for any end-of-life and funeral costs.

How much does it cost to pass away in Mississippi?

In addition to funeral costs, life insurance is typically used for other end-of-life expenses including:

- Monthly bills

- Everyday expenses

- Co-signed debt

- Childcare

- College tuition or education

Life insurance policies do not include guidelines on how beneficiaries must spend the payout money.

What Isn't Covered by Mississippi Life Insurance?

In order for a Mississippi life insurance policy to pay out, the death must be related to an illness, accident, or natural cause.

In addition to some exceptions to these, life insurance will not pay out in the following circumstances.

- Fraud and criminal activity: Deaths related to fraud or criminal activity are excluded in fraud and material misrepresentation.

- Suicide: Many policies will not cover suicide if the person dies within a certain time frame of purchasing the life insurance policy. Typically this is two years.

- Inactive or expired policy: If you have a term policy and you let it expire, it will not pay out.

Do I Need Life Insurance in Mississippi?

Life insurance is not required like many other types of insurance. Its sole purpose is to provide a financial safety net for those you leave behind.

"Even if you don't have a family, you have to ask yourself, if I were to pass away, would someone have to take care of my final expenses?" explained Martin.

It's also important to think beyond the funeral costs. For young families should a parent pass away, the remaining parent is left with all of the current and any future bills. Life insurance can be used to pay for college tuition, a down payment on a house, or a car for your child.

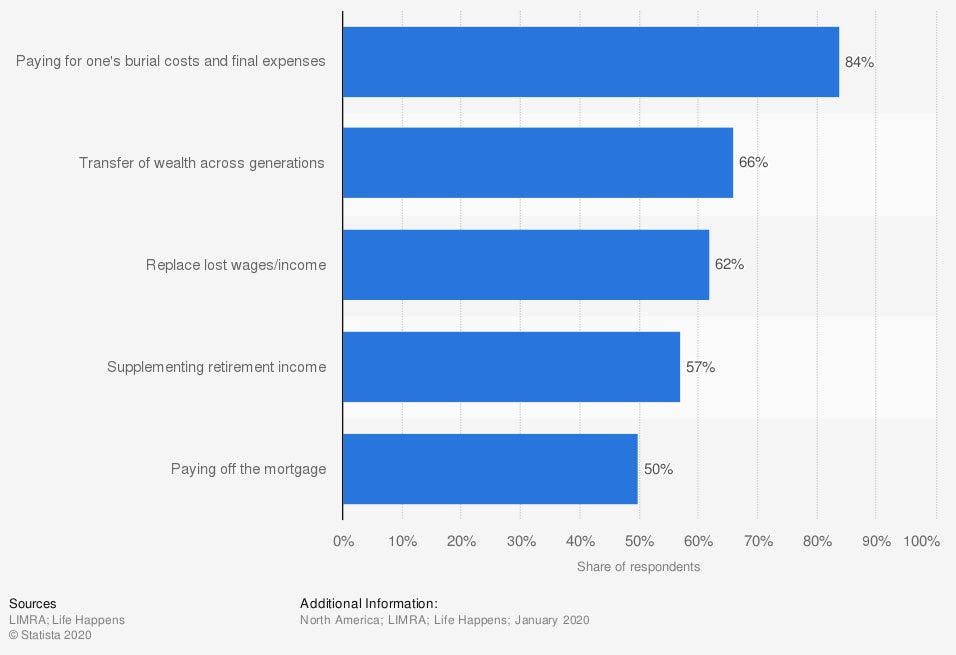

Why own a life insurance policy?

84% of Americans own life insurance to assist their families with paying for burial-related costs when they die.

How Much Is Life Insurance in Mississippi?

Most life insurance policies are affordable. Seeing as a company is insuring your life, they'll look at a variety of factors when determining your premium prices.

- Whether you choose term or whole life insurance

- Age

- Medical history

- Gender

- Occupation

- Your habits

- Overall health

Life insurance policies can range from $10/month to several hundred or more. Working with a Mississippi independent insurance agent, you can shop multiple quotes to find an affordable policy.

How Much Life Insurance Do I Need?

Determining the amount of life insurance you need requires some planning. It's easiest to sit down, including your spouse if you have one, and go through all of your current and potential future expenses.

Expenses to consider when thinking about life insurance

- Mortgage

- Car payments

- Bills

- Groceries

- Tuition

- Future vehicle purchases

- College loans

- Debt

- Property

Once you've gotten a number for your current and predicted expenses, Martin recommended multiplying that number by twelve. This will provide one year of expenses should you pass away.

Where Can I Purchase Life Insurance in Mississippi?

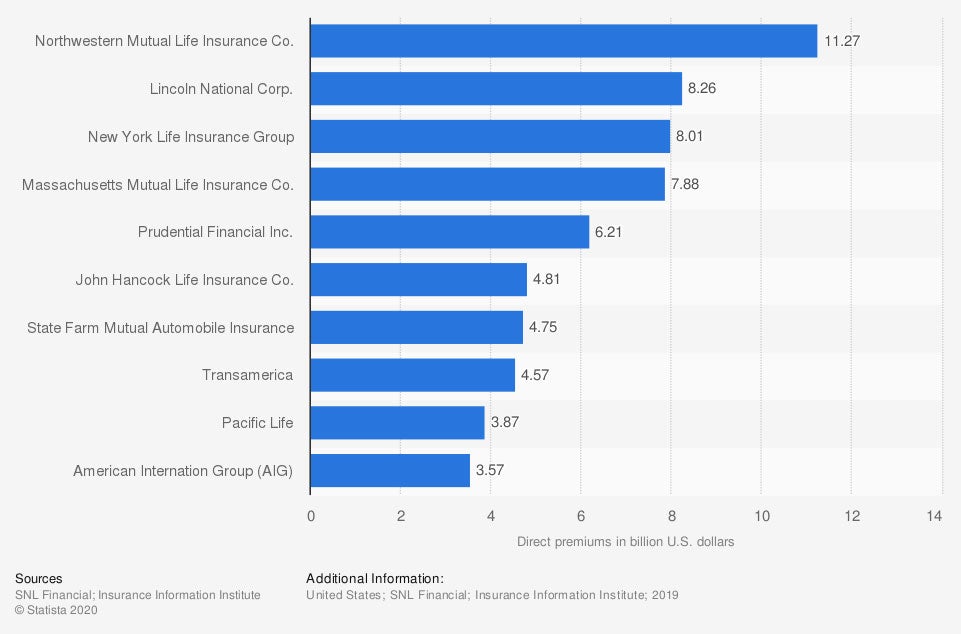

Nearly every insurance carrier writes life insurance policies, but some companies are known for selling more life insurance than others.

The following are the leading writers of individual life insurance policies in the US

Leading writers of individual life insurance in the US

In Mississippi, $22 billion in life insurance purchases are made every year.

How a Mississippi Independent Insurance Agent Can Help You

Life insurance can be a valuable insurance option for those looking to support their loved ones long after they're gone. With a variety of policy choices, it's easiest to work with a Mississippi independent insurance agent.

They are experts in life insurance and will sit down with you, free of charge, to review your needs. They can assist you in listing out your expenses and will shop multiple life insurance carriers to find you the most affordable option. Should you need to review or update your policy, they can assist with that as well.

Author | Sara East

Article Reviewed by | Paul Martin

http://www.mid.ms.gov/consumers/life-insurance-annuities.aspx

https://worldpopulationreview.com/state-rankings/average-funeral-cost-by-state

© 2024, Consumer Agent Portal, LLC. All rights reserved.