Cost of Car Insurance in Mississippi

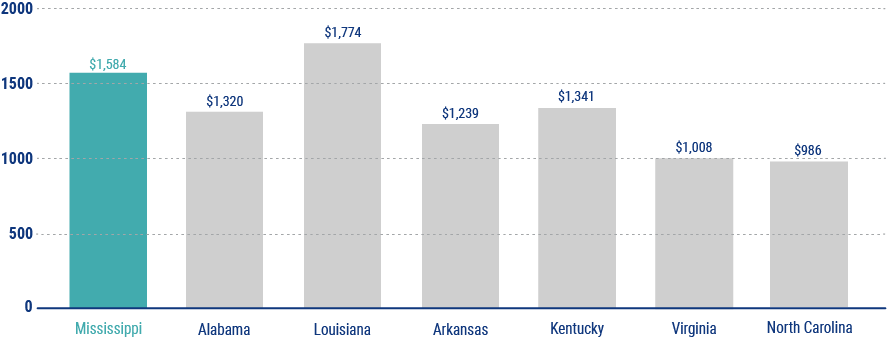

While Americans pay an average rate of $1,311 a year for their car insurance, in Mississippi, the average cost is $1,584. Insurance costs will vary from driver to driver because they are based on a number of factors such as your age, occupation, and driving record. Information about the vehicle, and even your credit score, can alter rates. Independent insurance agents can help you obtain and compare a selection of customized quotes so you can be sure you are getting your coverage at a good price.

Average Cost of Car Insurance Per Year in MS