Cost of Workers’ Compensation Insurance in Mississippi

Workers compensation rates in Mississippi are about 15% lower than the national averages. Costs for coverage are based on the types of jobs your employees do, the injury risks in your industry, and your company's overall payroll. Rates are regulated by the Mississippi Workers’ Compensation Commission and the Mississippi Insurance Department. This coverage can be purchased through a commercial provider, which may offer policy discounts of up to 25% for qualified employers.

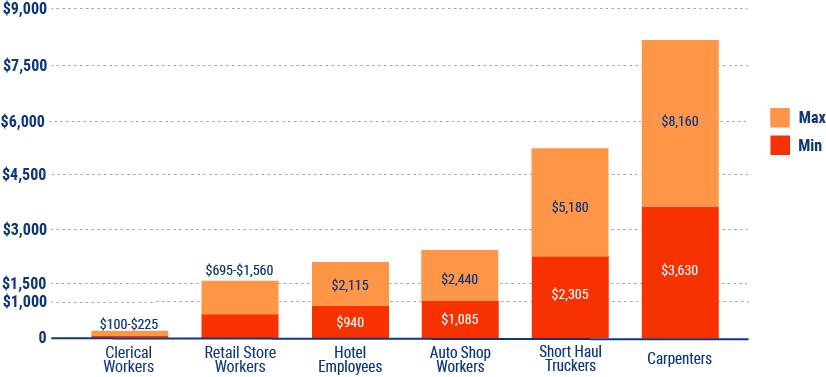

Average Cost Range for Workers' Compensation Insurance in Mississippi (Per $50,000/yr in Payroll)