In Mississippi, if you park your vehicle outside your home, you run the risk of an unexpected accident causing damage to your car. One example is your neighbor's tree falling into your yard. If a Mississippi storm causes your neighbor's tree to fall onto your vehicle, who's responsible?

The good news is that most Mississippi independent insurance agents have experience dealing with these types of accidents and can help you secure the proper car insurance you'd need to cover these types of events. Here's what you need to know if your neighbor's tree causes you car damage and how an agent can help.

Who's Responsible If a Neighbor's Tree Falls on My Car?

If a neighbor's tree falls onto your car, causing damage, knowing who is at fault starts with what caused the tree to fall. Trees can break or fall for numerous reasons, but your neighbor can only be held responsible for the damage if they were negligent in caring for the tree. In this case, you'd have to prove to your insurance company that your neighbor neglected the tree, causing it to eventually collapse into your yard.

Most of the time, a fallen tree results from a severe storm or other act of God. In these scenarios, your Mississippi car insurance would cover any damage to your vehicle, but only if you had comprehensive coverage. That's why it's so beneficial to understand the different car insurance options in Mississippi so you can ensure that you have the right coverage.

What Does Car Insurance Cover in Mississippi?

When purchasing car insurance in Mississippi, it helps to understand what coverages are required by law and what coverages are optional. In this state, every registered driver must carry liability insurance, including bodily injury protection and property damage protection.

- Bodily injury liability: Helps pay for medical costs for the other driver in an accident. It will also pay for legal fees and additional associated costs if you're sued after an at-fault accident.

- Property damage liability: Helps pay to repair or replace the other driver's property that you damage with your vehicle. This includes things like buildings, fences, and their vehicle.

- Uninsured motorist coverage: Not required by law in Mississippi, but this helps pay for personal damage and injuries if you're in an accident with a driver who does not have insurance or is underinsured.

In addition to these basic coverages in Mississippi, it's worth considering the following coverages to make sure that you're adequately protected.

- Collision coverage: Pays to repair or replace your vehicle if it is damaged or totaled in a collision, regardless of fault.

- Comprehensive coverage: Pays to repair or replace your vehicle if it is damaged or totaled by a non-collision event such as a hailstorm or theft.

- Medical payments coverage: Pays for personal injuries in an at-fault accident or after a hit and run.

A Mississippi independent insurance agent can work with you to understand your coverage options and select policies that protect you against your risks.

Will My Mississippi Car Insurance Fully Cover the Damage to My Car?

When you purchase car insurance, you'll select your policy limits, which determine how much money your policy will pay out in an accident. Should you need to file a claim, you would be financially responsible for your deductible before your policy would cover the rest of the damage up to your policy limits. As long as you have comprehensive coverage, you'd be covered up to your policy limits if your neighbor's tree fell on your vehicle.

What If the Neighbor Was Trimming a Branch from the Tree and It Fell on My Car?

If your neighbor is trimming their tree and does not take preventive measures to stop the branches from falling on your vehicle, they can be held responsible for the damage.

In this scenario, your neighbor could be considered negligent. You would still file the claim with your insurance, but they would work with your neighbor's insurance to resolve the claim. Sometimes proving negligence is extremely challenging and depends upon the facts of the case, and even if it were your neighbor's fault, your car insurance policy would still cover the damage.

What If My Car Doesn’t Have Comprehensive Coverage, Can My Home Insurance Cover It?

Mississippi homeowners insurance would not cover a neighbor's tree falling on your vehicle, so you would need to have the proper car insurance to receive coverage. Since comprehensive insurance is not required in Mississippi, it's worth it to work with an agent to secure this coverage.

Car Insurance Stats

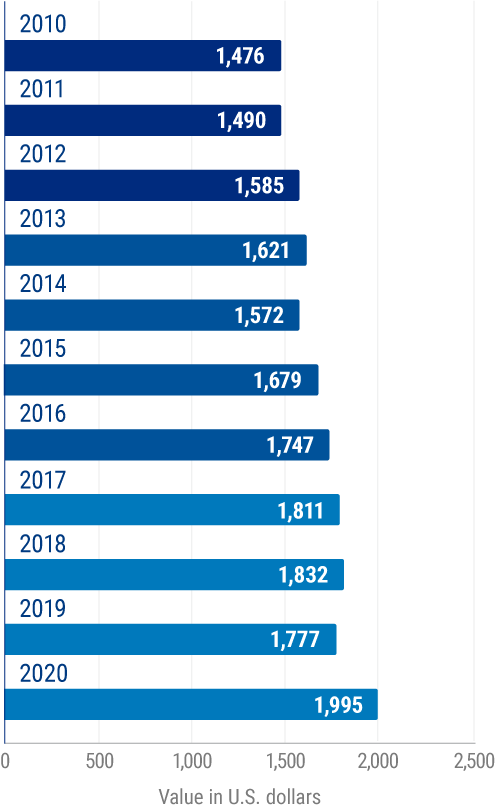

Average Value of Private Passenger Auto Comprehensive Insurance Claims

In one recent year, the average value of private passenger auto comprehensive insurance claims was the highest value recorded in history. The average value was $1,995, which was a significant increase from the $1,777 recorded in the previous year.

Here’s How a Mississippi Independent Insurance Agent Would Help

Without proper car insurance, your vehicle is at risk of several potential hazards. The easiest way to get answers to your questions and find the right coverage is to work with a Mississippi independent insurance agent.

Agents will speak with you, free of charge, to learn about your needs. They'll shop multiple carriers to pull you several quotes and guide you in selecting a Mississippi car insurance policy that is affordable and comprehensive.

Article Reviewed by | Paul Martin