It's easy to get so caught up in maintaining a property that you forget about protecting it. When a loss occurs, it not only alters your life, but could also affect your finances without proper coverage. Fortunately, Mississippi homeowners insurance can help with a fire claim.

A Mississippi independent insurance agent will review your policies for free, making sure there are no gaps. They'll even do the shopping for you so that you can relax. Connect with a local expert to get started.

What Does Homeowners Insurance Cover in Mississippi?

In Mississippi, your home is your safe haven, but a loss is sometimes unavoidable. Your primary policy will automatically cover common claims like severe weather damage, lightning, tornadoes, and fire.

How your home coverages are broken down:

- Dwelling limit: Pays for the replacement or repair of your home itself when a covered claim occurs.

- Personal property: Pays for the replacement or repair of your personal belongings.

- Personal liability: Pays for bodily injury, property damage, or slander claims against a household member.

- Additional living expenses: Pays for your temporary stay at another property when a claim renders your home unlivable.

- Medical payments: Pays for the first $1,000 - $10,000 of a medical expense when a third party gets injured on your property.

Can I Purchase Homeowners Insurance after a Fire in Mississippi?

Most carriers will allow you to purchase homeowners coverage through them even with a past fire loss. However, if you have more than two home claims, you could have trouble finding inexpensive coverage. Take a look at what could impact your Mississippi home the most:

- Severe storms and lightning

- Burglary and other property crimes

- Hurricanes and tropical storms

- Tornadoes

- Flooding and water damage

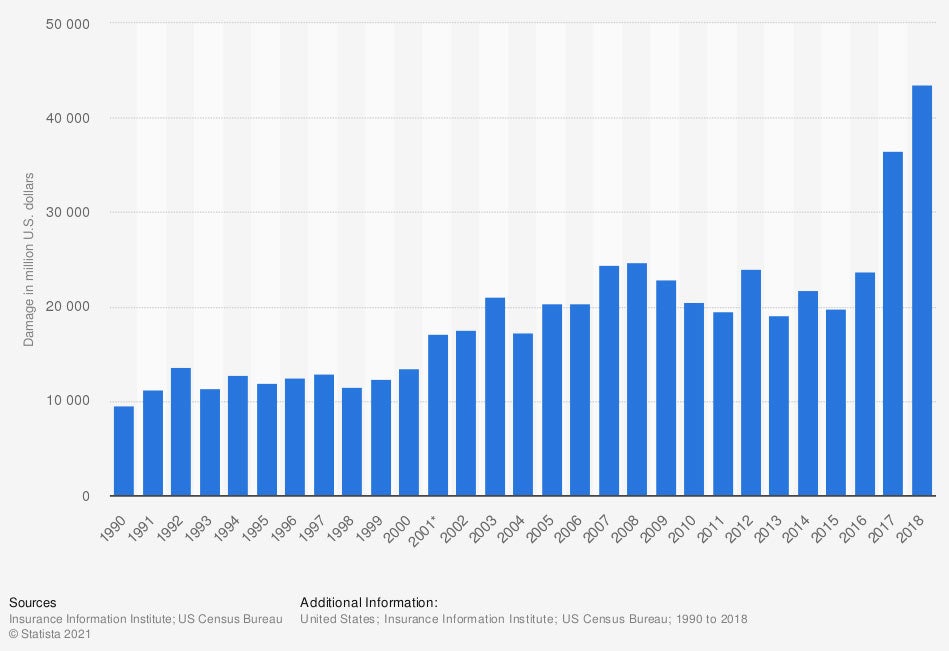

Total incurred losses due to fire in the US (in million US dollars)

When it comes to owning a property, you have to be prepared for the worst and hope for the best. It doesn't hurt to be proactive in your coverage, either.

Does Mississippi Home Insurance Protect against Fires?

Homeowners insurance policies will have coverage for fire losses built in. Most home insurance is written on a special form policy giving you comprehensive coverage for different types of claims.

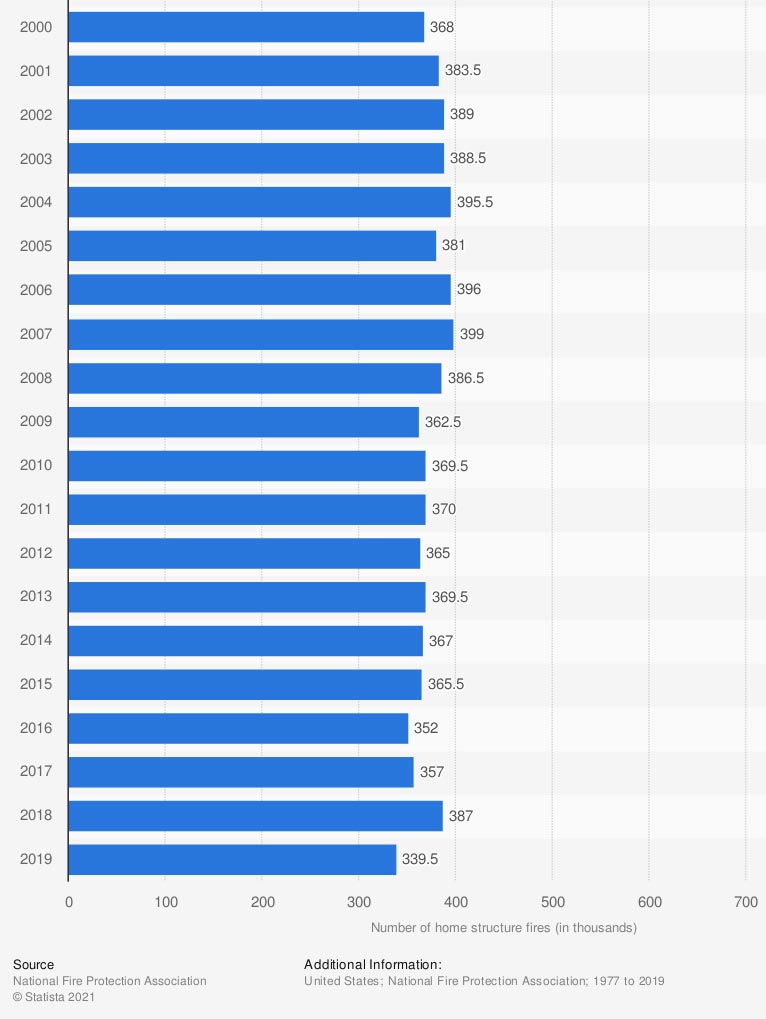

Total number of reported home structure fires in the US (in thousands)

When speaking with a trusted adviser, be sure to ask if your homeowners policy is on a special form for the most coverage and fire loss protection. This ensures that you're completely covered against all life throws at you.

Will My Location Impact My Rates in Mississippi?

The average annual Mississippi homeowners insurance premium is $1,537. Each property will have a different rate based on location, local crime, past losses in the area, and flood zones. While you won't know exact costs until you obtain quotes, where you live does affect your insurance premiums.

How a Mississippi Independent Agent Can Help

When you're looking for a homeowners policy that protects without costing a fortune, you're not alone. With all the coverage options on the market, finding the right policy can be a challenge. Fortunately, a licensed professional can help for free.

A Mississippi independent insurance agent does the shopping for you with their network of carriers. This ensures you're getting the best coverage in town. Connect with a local expert on TrustedChoice.com for custom quotes to get started.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/198884/total-fire-losses-in-the-us-since-1990/

https://www.statista.com/statistics/376918/number-of-home-structure-fires-in-the-us/

http://www.city-data.com/city/Mississippi.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.