When you're one of the 257,404 small businesses in Mississippi, you'll want adequate protection. There are multiple policy options your company will need. Mississippi business insurance can come with business interruption coverage.

Fortunately, a Mississippi independent insurance agent can help with policy and premiums that won't break the bank. They do the comparison shopping for you at no additional cost. Connect with a local expert for tailored quotes.

What Is Business Interruption Insurance?

Does your Mississippi business have enough cash flow to go a month or more without any income? Business interruption insurance can help you stay operational during a loss.

- Business interruption insurance: Pays for regular business expenses in the event of a covered loss. This coverage will help your company avoid closure.

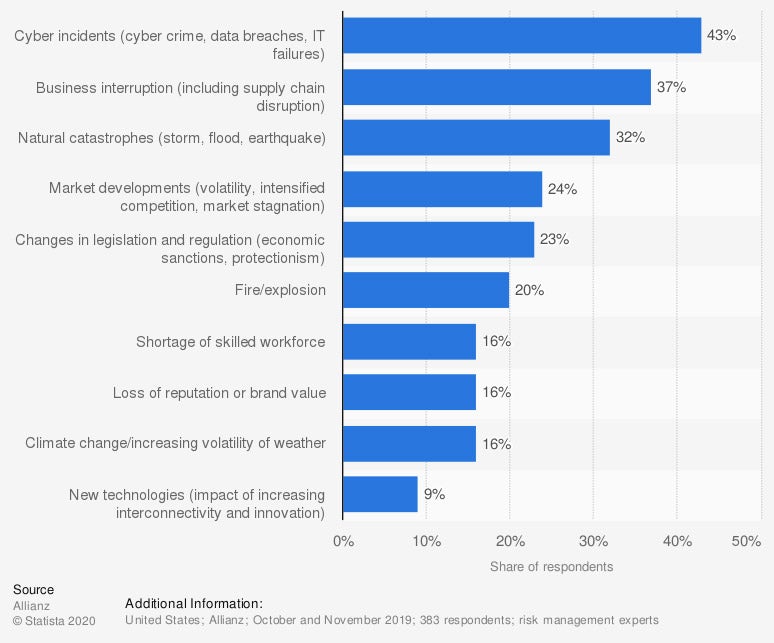

Leading risks to US businesses in 2020

Business interruption is the second biggest risk to businesses in the US. If you're without proper limits of protection, your operation could find it hard to recover from a loss.

What Does Business Interruption Insurance Cover in Mississippi?

Your Mississippi commercial insurance can cover some of your most significant exposures. Take a look at what's typically included under business interruption insurance:

- Income: This will be based on what income would normally have come into your business historically during the same time.

- Payroll: Any payroll you usually pay will be taken care of under this coverage.

- Taxes: If your loss occurs during tax season, you'll have coverage for business taxes due.

- Rent or mortgage: If the building you occupy is unusable, the rent or mortgage will be paid by this coverage.

- Relocation: If you have to move to a temporary location, business interruption will help pay the bill.

- Loans: Any loan payments you have incurred are part of this regular expense.

Business Interruption Insurance Costs in Mississippi

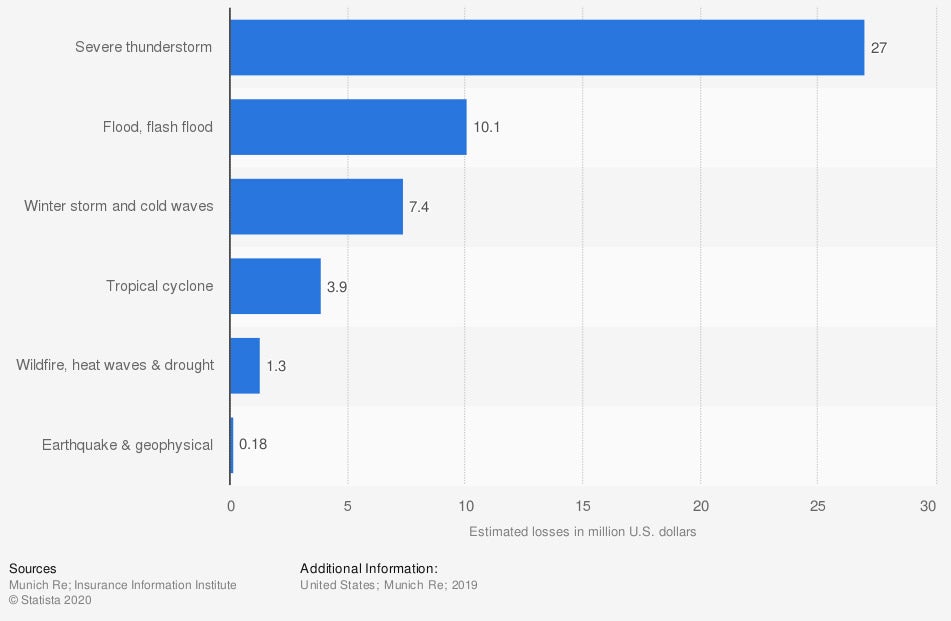

Like any other insurance you obtain, coverage and pricing will be unique to you. Business interruption insurance will be rated on many factors, including the local crime rate, your insurance score, loss history, location, and more. Check out which catastrophes are most common in Mississippi below:

Mississippi natural disasters that will impact your premiums:

- Severe storms and lightning damage

- Burglary and other property crimes

- Hurricanes and tropical storms

- Tornadoes

- Flooding and water damage

The number of natural disasters in the US by type (in 2019)

Natural disasters and catastrophes can seriously impact your operation. If you have to halt business due to a loss, you could be out a lot of money. Fortunately, business interruption insurance can help.

Business Interruption Insurance Exclusions in Mississippi

Every policy will have a list of items that your coverage won't insure. It's key to be aware of what your carrier insures and what they don't. Check out some standard exclusions that are usually not covered under your Mississippi business interruption insurance:

- A pandemic: When a pandemic occurs, neither your business interruption nor any other commercial policies will provide coverage for a closure.

- Flood insurance: If you don't currently have a flood insurance policy, you won't have coverage for flooding under your business interruption coverage.

- Earthquake insurance: If you don't have earthquake insurance before your business is compromised, interruption coverage won't cover damage for this.

- Undocumented income: If your business is used to dealing only in cash with no paper trail, business interruption coverage will only apply to expenses that can be proved.

Indemnity Period for Business Interruption Insurance in Mississippi

Mississippi commercial insurance will protect your business in one of two ways. The first is a limit of coverage, and the second is a set period of time. Business interruption insurance goes by an indemnity period.

- Indemnity period: The amount of time a select coverage will pay out a covered loss.

Business Interruption Insurance Extra Expense in Mississippi

In Mississippi, $3,120,632,000 in commercial insurance claims were paid in 2019 alone. If damage from a covered event leads to temporary closure of your business, you may have additional costs. Your business interruption coverage will have a way to add protection for these extra costs.

- Extra expense coverage option: This will pay for extra expenses outside of your regular business expenses that are caused by a covered claim.

Small Business Interruption Insurance in Mississippi

Mississippi currently has 440,399 people employed by small businesses. If you have employees, they will be out of a job when you have to stop operating due to a claim. Business interruption insurance can help.

Unfortunately, most small business owners won't have enough money saved to pay for payroll and other expenses if a loss closes their doors. Business interruption insurance can help make ends meet for 12 to 24 months and is added to most general liability or business owners policies.

How to Connect with an Independent Agent in Mississippi

Your commercial insurance is essential to running a smooth operation. Instead of going it alone, consider consulting with a licensed adviser so that you get the right protection. Mississippi business interruption insurance can help cover your risk.

A Mississippi independent insurance agent will have access to several carriers so that you have options. They review your policies at no cost so that you get the best insurance in town. Connect with a local expert on TrustedChoice in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/422203/leading-business-risks-usa/

Graphic #2: https://www.statista.com/statistics/216819/natural-disasters-in-the-united-states/

http://www.city-data.com/city/Mississippi.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.