When you own a business, there are several coverages necessary to protect your assets. If you have a loss, it could wipe you out financially without a proper policy in place. Mississippi commercial insurance can help cover your jewelry store from disaster.

The best way to begin is through a Mississippi independent insurance agent. They'll do the shopping for free using a network of carriers, so you have options on policy and price. Get connected with a local expert for tailored quotes today.

What Is Jewelry Store Insurance?

Your Mississippi jewelry store will have numerous policies to protect every exposure necessary. Check out some common coverage choices for jewelry stores below:

- General liability: Pays for a bodily injury and property damage loss of others.

- Business property: Pays for the replacement or repair of company-owned property and belongings.

- Business interruption: Pays for regular business expenses while your company has to shut down due to a covered loss.

- Business inventory: Pays for the replacement or repair of company-owned inventory.

- Business equipment breakdown: Pays for replacing or repairing company-owned equipment that breaks down due to a covered loss.

- Commercial umbrella liability: Pays for a bodily injury and property damage loss of others after it exhausts your underlying limits.

- Workers' compensation: Pays for medical expenses and lost wages of an injured or ill employee resulting from job duties.

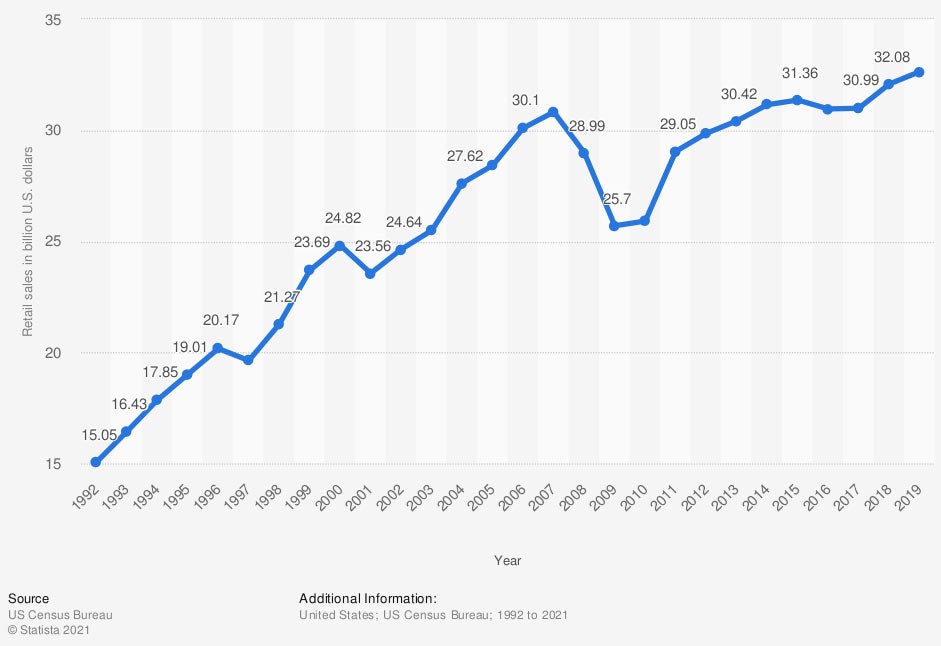

Jewelry store sales in the US

Sales in the jewelry industry are booming. When you have a hot commodity, it's best to protect it.

What Does Jewelry Store Insurance Cover in Mississippi?

In Mississippi, there are 257,404 small businesses in operation. If you're one of them, you'll have standard coverage options that are the foundation of your policies. Let's look at common jewelry store coverages:

- Coverage for bodily injury or property damage claims

- Coverage for your business inventory such as products

- Coverage for business equipment that breaks down due to a covered loss

- Coverage for employees who are injured or become ill on the job

- Coverage for commercial vehicles used to operate the business

- Coverage for disgruntled employees that sue due to discrimination or harassment

Every policy will come with primary protected losses such as fire, natural disasters, theft, vandalism, and water damage. You and your agent will preselect the limit it covers up to under your policies.

How Much Is Jewelry Store Insurance in Mississippi?

In Mississippi, $3,120,632,000 in commercial insurance claims were paid in one year alone. The carriers look at various risk factors when calculating your rates. Take a look at the information companies use when quoting:

- Loss history

- Replacement cost values

- Insurance score

- Experience level

- Type of retail store

- Location

How Much Theft Is Covered with Mississippi Jewelry Store Insurance?

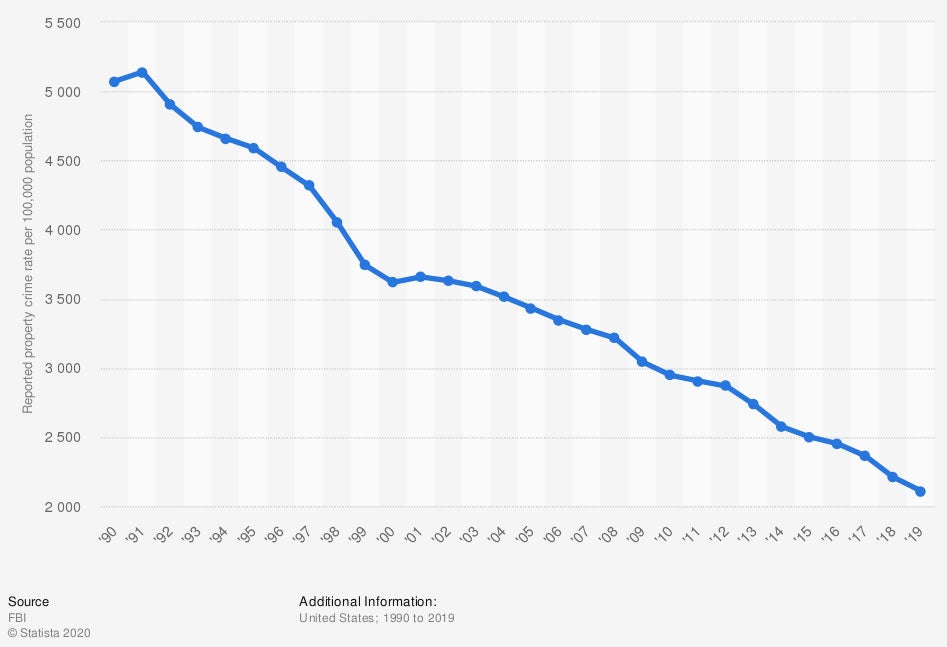

Jewelry stores are even more at risk for pricey merchandise getting stolen or vandalized. Your jewelry inventory will usually be covered up to the appraised value under your policy. Take a look at the property crime rates below:

Reported property crime rates in the US

The local crime rate in Mississippi will impact your insurance costs. It may also limit the amount of coverage the carriers are willing to offer. To find out how much coverage carriers will allow for your company, consult with a professional.

Will My Mississippi Location Impact My Insurance Rates?

Where your jewelry store puts down roots determines how much you pay for coverage. Anything from weather losses and crime rates to flood zones will impact your costs. If you're in a high-risk flood zone, you'll be required to carry a separate flood insurance policy, which will cost an additional premium.

How an Independent Insurance Agent Can Help in Mississippi

If you own a jewelry store in Mississippi, there are a lot of moving parts. Some you'll know how to handle, while others require help. A licensed professional will review your policies beforehand so that you're covered.

Fortunately, a Mississippi independent insurance agent has access to multiple markets at once, making it easy. Your coverage is super-important to the success of your business, which means you'll need the proper protection. Connect with a local expert on trustedchoice.com for custom quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/197698/annual-jewelry-store-sales-in-the-us-since-1992/

https://www.statista.com/statistics/191237/reported-property-crime-rate-in-the-us-since-1990/

http://www.city-data.com/city/Mississippi.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.