Mississippi has 257,404 small businesses that are currently in existence. If you're in charge of a company, you'll have to account for all that could go wrong. Fortunately, Mississippi business insurance can provide coverage for your cotton farm.

A Mississippi independent insurance agent will have access to multiple markets, ensuring that you're presented with the best options out there. They'll even do the shopping for you at no additional charge. Connect with a local expert for tailored quotes in minutes.

What Does Cotton Farm Insurance Cover in Mississippi?

Cotton farm insurance in Mississippi will come in many forms. From property to liability insurance, you'll want protection for all your exposures.

What your cotton farm insurance generally covers:

- General liability: A general liability policy will provide bodily injury and property damage coverage.

- Commercial property: This policy covers your farm structures, pole barns, and can even insure your equipment.

- Accidents: This can be anything from coverage for electrocution, fire, and smoke, to loading and unloading of livestock.

- Natural disasters: Volcanic eruptions and sinkholes are covered. Typically, floods and earthquakes are covered under a separate policy.

- Weather events: Lightning, wind, hail, tornadoes, and more.

- Crimes and civil unrest: This is for theft and vandalism of livestock.

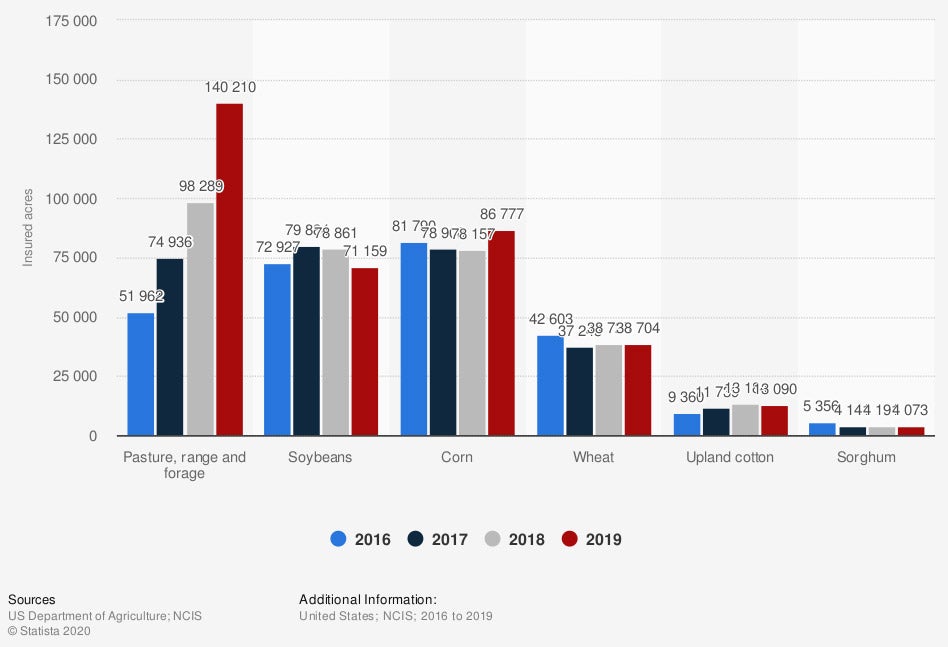

Volume of insured acres of farmland in the US from 2016 to 2019 (by crop)

If you're using your farm's acres to grow cotton for production and sale, then you'll want adequate protection. Crop coverage is a policy that is separate from the rest.

What Doesn't Cotton Farm Insurance Cover in Mississippi?

Your Mississippi cotton farm insurance won't automatically include coverage for your crops. It's essential to understand what policies you might need to add to your primary coverages when you run a farm. Take a look at the standard policies that are excluded and require a separate policy for your cotton farm:

- Crops: Your farm's crops will be covered under a separate crop policy for any damage.

- Vehicles: Some insureds think automobiles or company vehicles fall under farm equipment, but they don't.

- Structures: If you want coverage for any buildings, it will fall under your farm's property coverage.

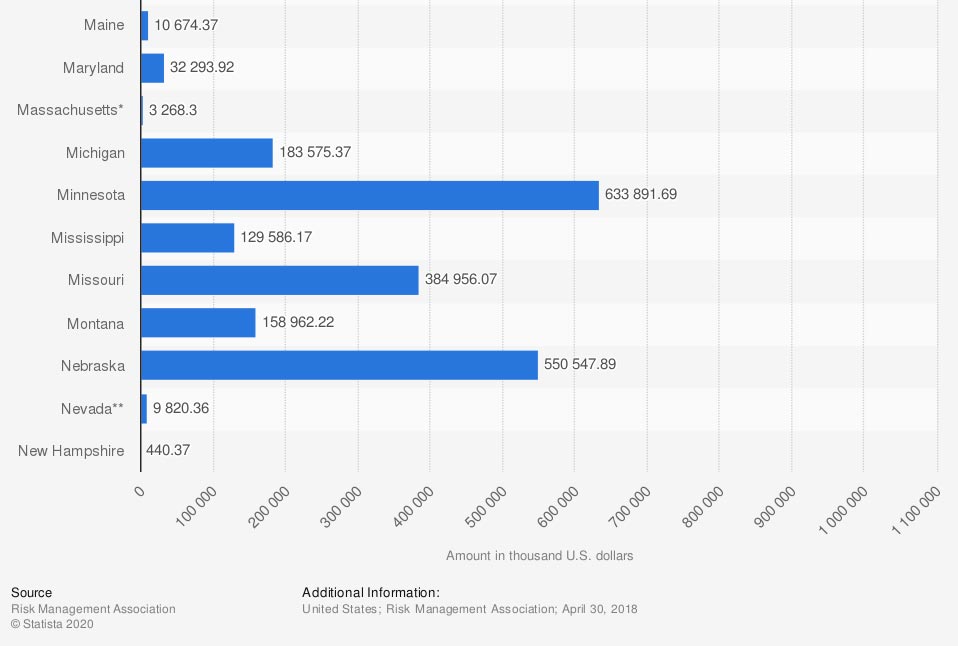

Value of crop insurance premiums in the US in 2019, by crop (in million US dollars)

If you run a cotton farm then you're high on the list when it comes to crop insurance in the US. There are several things you can grow, and knowing the different coverage options for your cotton farm is key.

Additional Coverage for Your Cotton Farm in Mississippi

Every business will have extended or optional coverages that can be added to enhance their insurance. It may be beneficial to review your policies with a trained professional for sufficiency. Check out some additional coverage options for your cotton farm in Mississippi that you may want to consider:

- Commercial umbrella insurance: This policy can be obtained for additional liability coverage above and beyond your underlying limits.

- Inland marine insurance for farm equipment: This can be added to a farm policy for anyone that uses equipment, tractors, and more for tending to their farm.

- Extended liability limits: You can increase your underlying liability limits for added coverage.

Common Risks for Your Cotton Farm in Mississippi

If you own a cotton farm in Mississippi, you'll need to take several risks into account. This includes local weather patterns, natural disasters, and crime. Take a peek below at what your farm could come up against in Mississippi.

Common Mississippi natural disasters that can impact your premiums:

- Severe storms and lightning damage

- Burglary and other property crimes

- Hurricanes and tropical storms

- Tornadoes

- Flooding and water damage

How to Connect with an Independent Insurance Agent in Mississippi

When you run a Mississippi cotton farm, you'll be responsible for a lot. From farmland to products and distribution, many things will need protection. To ensure that you're getting the proper coverage limits, consider consulting with a licensed adviser.

A Mississippi independent insurance agent can help you find a policy that's affordable and suits your needs. Since they work with several markets, you'll always get the best premiums. Connect with a local expert on TrustedChoice for custom quotes to begin.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/723015/volume-of-insured-acres-of-farmland-usa-by-crop/

Graphic #2: https://www.statista.com/statistics/723049/value-of-crop-insurance-premiums-usa-by-crop/

http://www.city-data.com/city/Mississippi.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.