In 2019, Mississippi had $3,120,632,000 in commercial insurance claims paid alone. When you're trying to protect your operation from all the what-ifs, you'll have many options. Your Mississippi business insurance should include cyber liability coverage.

Fortunately, a Mississippi independent insurance agent can help. They have policy and premium choices to fit your budget. Get connected with a local expert for custom quotes today.

What Is Cyber Liability Insurance?

In Mississippi, your business will need all sorts of protection. Cyber liability insurance is often overlooked, but it shouldn't be. It can help cover your company from a major lawsuit. Check out how it works below.

- Cyber liability insurance: Pays for your legal, defense, and settlement costs when the sensitive employee or client data is compromised virtually. It will also pay for notification expenses to the public and customers when a cyberattack occurs.

Cyber Liability Insurance Costs in Mississippi

Similar to your other commercial insurance policies, like workers' compensation or business auto, the costs will vary. Cyber liability insurance in Mississippi will be specific to each entity, and so will the pricing. Take a look at what carriers use to determine premiums.

- Gross annual income

- Cyber protection plans in place

- Updating of software

- Type of data stored

- Access points to data

- Malware used

Another area they will look at is prior claims reported. If you have a history of past losses, this could significantly impact your rates. Take a look at the global costs below.

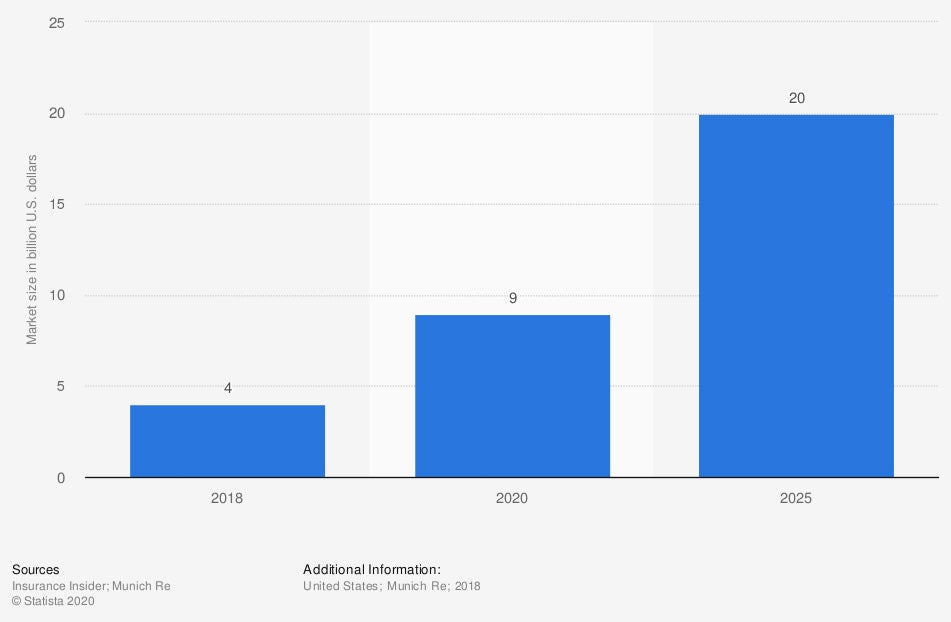

Cyber Liability Insurance Market Size Globally

While you won't know your exact premiums until you obtain quotes, this gives you a good idea of how it's calculated. Cyber liability insurance can be discussed further with your Mississippi adviser.

Who Needs Cyber Liability Insurance in Mississippi?

A cyberattack could cost your Mississippi business hundreds of thousands of dollars in loss. When you have a data breach of client or employee information, you'll be responsible for the damage. Take a look at where cyber liability insurance is most helpful.

- If you own a business

- If you own a small or large business

- If you use email

- If you have internet

- If you obtain employee data electronically

- If you obtain client data electronically

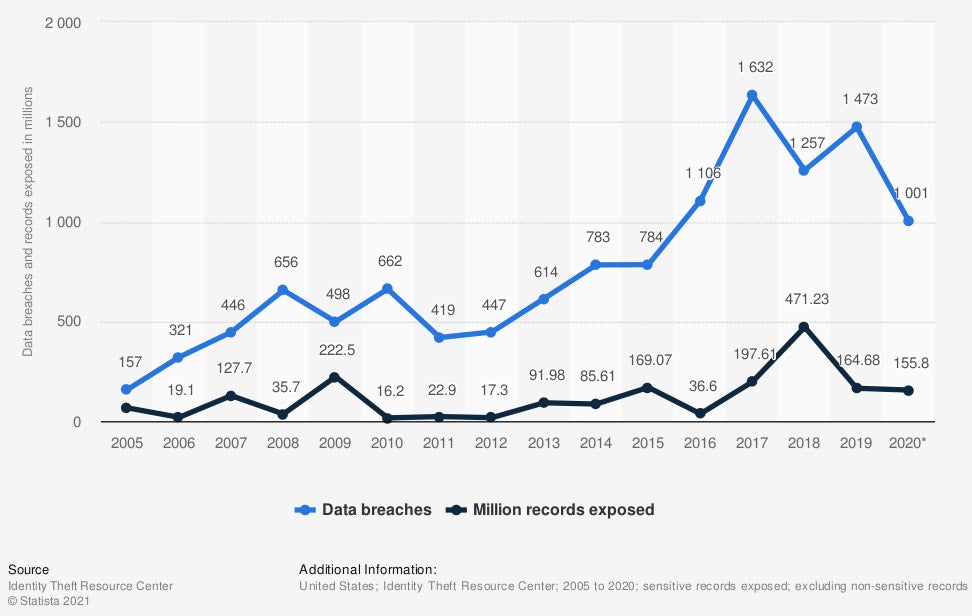

The number of data breaches that occur are only rising. Take a look below at the numbers from 2005 to 2020.

Cyber Data Breaches and Records Stolen in the US

Whether you run a big operation or a small business, you'll want protection for cyber theft. If you're using computers, software, or even email, you're at risk already.

Cyber Liability and Data Breach Insurance in Mississippi

In Mississippi, your cyber liability insurance policy will have two coverage parts. The first limit refers to data breaches and informing the public. The second limit is the cyber liability portion and helps pay for the remainder of the loss. Take a look at how it works.

When data breach coverage applies

Data breach insurance will apply when you have a breach of data and you need to restore what was compromised. Coverage can be in the form of alerting the public of breach, fraud alert, identity restoration, consulting services, and more. This coverage is utilized first in the claims process.

When cyber liability insurance applies

Next, cyber liability insurance would apply when an employee, client, or member of the public files a lawsuit. The lawsuit is due to the data breach that occurred and any sensitive information that may have been stolen. Cyber liability will pay for defense and settlement costs of a loss.

Cyber Liability Insurance for Law Firms in Mississippi

Mississippi has a general population of roughly 2,990,468 residents. If you're one of them and own a law firm, you'll have access to a lot of sensitive information. Your attorney-client privilege will be out the window if your data gets hacked. Cyber liability insurance can help soften the blow and the expense. Check out what it will assist law firms with.

- Attorney fees

- Defense fees

- Settlement fees

- Informing the public

- Informing your clients

Cyber Liability Insurance for Small Businesses in Mississippi

In Mississippi, there are roughly 257,404 small businesses in existence. If you're running a company, many losses could cause a closure. Here are some reasons why you'll need cyber liability insurance if you're a small business.

- You may not have the cash flow to pay out of pocket

- Legal fees could wipe out your reserves

- There could be multiple lawsuits filed against you for one instance

- Informing the public can cost additional funds you don't have

- It will keep your business operational during a lengthy legal battle

- It can help restore your stolen data

Cyber Liability Insurance for Technology Companies in Mississippi

Your Mississippi technology company may be at a higher risk of getting attacked because of the nature of the business. While you are helping your clients protect their data, you'll want to consider yours. Unfortunately, as a technology company, you'll pay some of the most expensive premiums for cyber liability coverage, but it's usually well worth it. Check out why cyber liability insurance is essential for a technology company.

- It will pay for your legal fees if a lawsuit arises from a data breach

- If your client gets hacked due to a system you implemented, this coverage, along with your other insurance policies, may respond

- When you're dealing with other people's sensitive data, your company may be a target for online predators

How to Connect with a Mississippi Independent Agent

Mississippi business insurance can be confusing when you're not a trained professional. Fortunately, there are trusted advisers who can help with coverage. Cyber liability insurance is one of the most important policies your operation owns and should be reviewed carefully.

A Mississippi independent insurance agent will have access to multiple markets so that you can save. They work on your behalf at zero cost to you, putting money back in your pocket. Connect with a local expert on TrustedChoice.com to get started.

Article Author and Expert | Candace Jenkins

Graph #1: https://www.statista.com/statistics/976526/global-cyber-insurance-market-size/

Graph #2: https://www.statista.com/statistics/273550/data-breaches-recorded-in-the-united-states-by-number-of-breaches-and-records-exposed/

http://www.city-data.com/city/Mississippi.html