In Mississippi, there are 257,404 small businesses, all with specific coverage needs. If part of your profession is giving advice, there are some things you need to know. Mississippi business insurance can help protect your practice by providing errors and omissions coverage.

A Mississippi independent insurance agent will have access to multiple carriers so that you have options. You'll get to pick which policies are right for you and how much you want to spend. Connect with a local expert for custom quotes in minutes.

What Is Errors and Omissions Insurance?

The advice your business gives to clients can make or break your operation. When you're consulting as a profession, you could be on the hook for a significant loss. Errors and omissions insurance, or E&O, can help protect your business against the following:

- Errors in services given

- Omissions

- Inaccurate advice

- Misrepresentation

- Negligence

- Violation of good faith and fair dealing

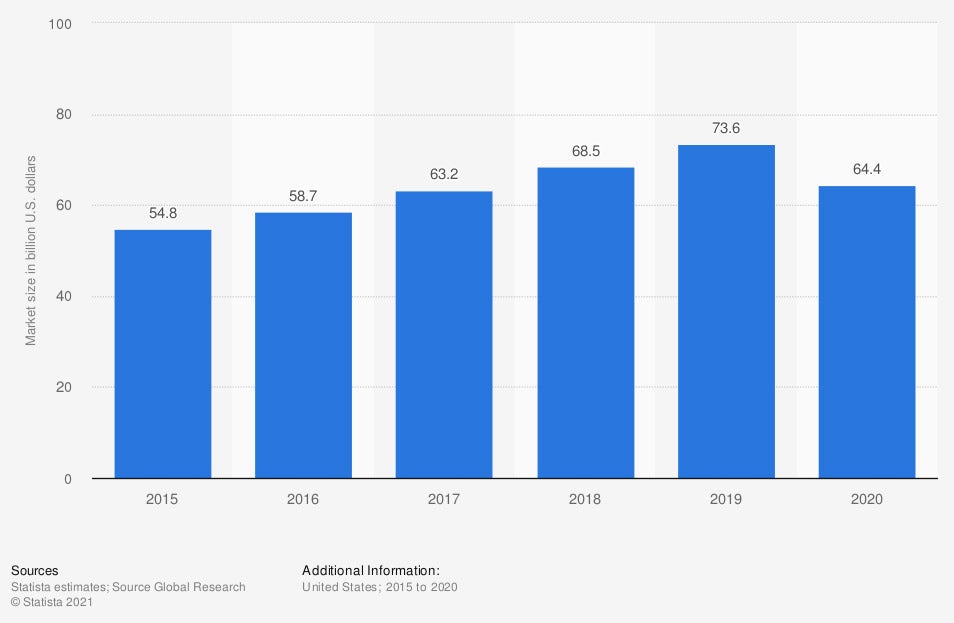

Size of the consulting market in the US from 2015 to 2020 (in billion US dollars)

If you're in the consulting game, you could be on track to a viable business. First, you should understand how coverage works and what's needed to be sufficiently insured.

What Does Errors and Omissions Insurance Cover in Mississippi?

Mississippi errors and omissions insurance can be overlooked by many of the professionals that need it the most. Your business's reputation and how you handle consulting clients are a big deal. E&O insurance usually applies these professionals:

- Real estate agents

- Business brokers

- Insurance agents

- Lawyers

- Financial advisers

- Consultants

Your Mississippi E&O insurance can help pay for specific parts of a lawsuit. Some of the most common are the following:

- Administrative fees

- Settlements or judgments

- Attorney fees

- Court fees

What Doesn't Errors and Omissions Insurance Cover in Mississippi?

All insurance policies come with exclusions that can either be paid for by the business or added through a separate policy. Mississippi E&O insurance is very specific to your consulting or advising practices. Check out what's typically excluded under your E&O insurance:

- Commercial property: Coverage for any building or belongings will have to be insured under a separate commercial property policy.

- General liability: Coverage for bodily injury or property damage claims will need a separate general liability policy.

- Employee coverages: Insurance for your employees will come in the form of a workers' compensation policy or employment practices liability insurance.

How Much Does Errors and Omissions Insurance Cost in Mississippi?

Every business will be rated on its unique risk factors and history. Insurance companies look at a variety of items when calculating your E&O costs. Check out what the carriers use to determine your Mississippi E&O policy premium:

- Number of claims in the area

- Your prior claims reported

- Your financial statements

- Your experience level

- How your business operates

- Safety measures taken

Who Needs Errors and Omissions Insurance in Mississippi?

In 2019 alone, Mississippi had $3,120,632,000 in commercial insurance claims paid out. Not every operation will need E&O coverage, but it's essential to understand whether your business does. Take a look at the following industries that may need E&O insurance:

- Consultants

- Engineers

- Lawyers and law firms

- Marketing agencies

- Financial services

- Real estate agents and insurance agents

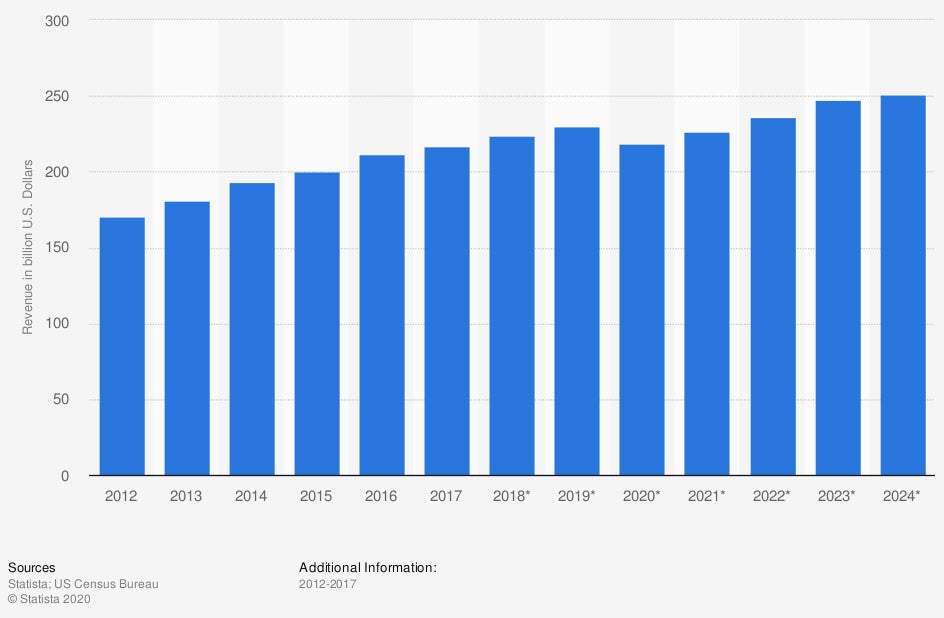

Industry revenue of management consulting services in the US from 2012 to 2024 (in billion US dollars)

If you're in the consulting business in any way, shape, or form, you'll probably need to consider E&O coverage. It's important to obtain the proper limits from the get-go.

Does Umbrella Insurance Cover Errors and Omissions in Mississippi?

A million dollars doesn't buy what it used to, and a claim against your business can easily reach seven figures. Fortunately, a commercial umbrella policy can help provide additional liability coverage for your practice. E&O protection is one exclusion that umbrella insurance has, which means you'll want adequate limits on your underlying E&O policy. Check out how business umbrella coverage works:

- Commercial umbrella insurance: This provides an additional liability limit for your underlying business insurance policies. It will pay for bodily injury, property damage, and slander losses that exceed your general liability, business property, and commercial auto policies.

How to Get Errors and Omissions Insurance in Mississippi

The right commercial insurance policy is crucial to avoid any out-of-pocket expenses for a loss. There are several coverages your business may need, and knowing what's necessary can be challenging. Errors and omissions insurance is vital for any operation that practices consulting in some way.

Fortunately, a Mississippi independent insurance agent can help with coverage and premium options that won't break the bank. Since they do the comparing, you can relax. Get connected with a local expert on TrustedChoice.com for instant savings.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/793147/consulting-market-size-united-states/

Graphic #2: https://www.statista.com/forecasts/409755/management-consulting-services-revenue-in-the-us

http://www.city-data.com/city/Mississippi.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.