When you own a farm, you'll be responsible for covering a lot of ground. Farmland can be a generous resource, or it can suck you dry if you're not fully protected. Mississippi business insurance can supply a farmland liability policy that fits.

Fortunately, a Mississippi independent insurance agent has access to a network of carriers so that you have options. They do the shopping for free, saving you time. Connect with a local expert to get started in minutes.

What Is Farmland Liability Insurance?

In Mississippi, your property and all its operations will need to have coverage in place. Multiple claims could arise, but liability is the primary policy.

- Farmland liability insurance: A general liability policy will provide bodily injury and property damage coverage for your farm.

What Does Farmland Liability Insurance Cover in Mississippi?

Your Mississippi farmland liability insurance will protect against bodily injury and property damage claims. However, several other losses should be on your radar when selecting policies.

Other risk factors your farm should consider covering:

- Commercial property: This policy covers your farm structures and pole barns, and can even insure your equipment.

- Accidents: This can be anything from coverage for electrocution, fire and smoke, to loading and unloading of livestock.

- Natural disasters: Volcanic eruptions and sinkholes are covered. Typically floods and earthquakes are covered under separate policies.

- Weather events: Lightning, wind, hail, tornadoes, and more.

- Crimes and civil unrest: This is for theft and vandalism of livestock.

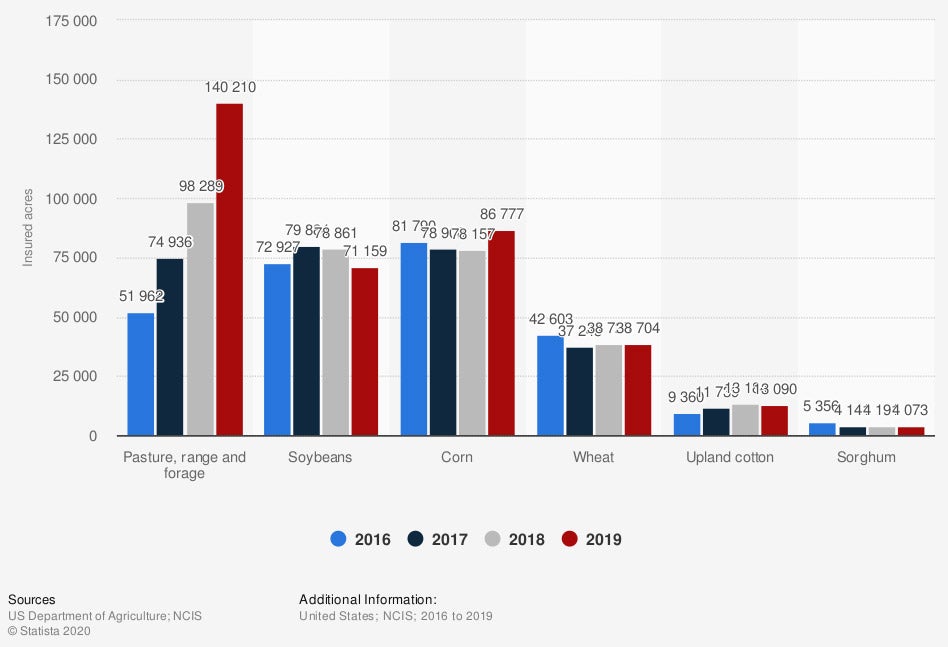

Volume of insured acres of farmland in the US in recent years (by crop)

The amount of farmland in the US is plentiful. If you own a small or big slice of the American dream, you'll want the proper coverage.

What Doesn't Farmland Liability Insurance Cover in Mississippi?

With every policy comes exclusions. Some coverages may not be automatically included in your farmland liability insurance.

Coverage that could be added but does not come standard on your policy:

- Attack by wild animals

- The collapse of a building on livestock

- Flooding

- Hail damage to crops

- Crop coverage

Your farm policy will exclude certain losses. Among them are death to your livestock by natural causes and old age.

What Does Farmland Liability Insurance Cost in Mississippi?

The exact costs for your farmland liability insurance will vary and need to be quoted through a professional. Check out what affects your premiums in Mississippi:

- Value of the land

- How many acres you have

- Past losses

- How the farmland is used

- If you have livestock

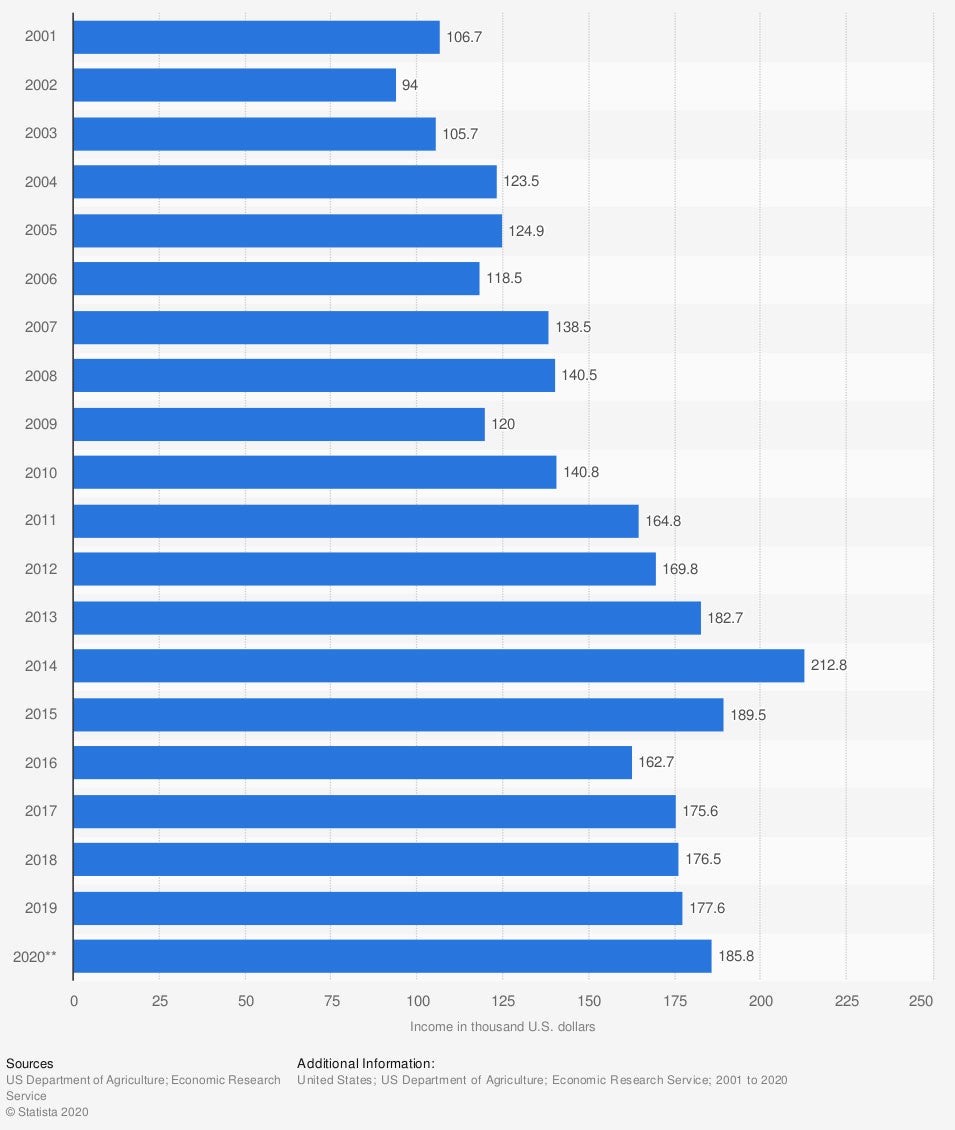

Total US farm income from livestock and products in recent years (in 1,000 US dollars)

If your farmland deals in livestock or goods sold from your business, then you're not alone. Your farm could be a significant resource for you and your family.

What Factors Could Affect My Farm Insurance Rates in Mississippi?

It's essential to understand how your farm insurance works and what risks you're insuring. The specifics of your operation can impact farmland liability premiums.

What will affect your farmland insurance costs:

- Your herd's specifics: You'll need to cover the risks that are specific to your herd. Horses will have different needs from cattle, and so on.

- What your livestock is worth: This is the value you can get in the marketplace for your livestock. You are covering the risk of the replacement cost if something happened to them.

- If you have crops: If your farm deals with planting and producing crops, you'll need separate crop insurance.

- Other structures and buildings: If you have a home, pole barns, and more on your property, you'll need coverage for the buildings themselves.

- What preemptive protection you have in place: Carriers will want to know how you are proactive, such as if you are accounting for the risk of predators by having fencing, and more.

How a Mississippi Independent Insurance Agent Can Help

If you own farmland in Mississippi, you'll want coverage for all those acres. With more land comes more responsibility, and liability insurance can help. Fortunately, you don't have to do it alone.

A Mississippi independent insurance agent will compare coverage and rates through their network of carriers. They do the shopping for free so that you're not wasting time searching for the perfect policy. Connect with a local expert on TrustedChoice.com to get started.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/723015/volume-of-insured-acres-of-farmland-usa-by-crop/

https://www.statista.com/statistics/196415/us-farm-income-from-livestock-and-products-since-2001/

http://www.city-data.com/city/Mississippi.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.