In 2019, Mississippi had $3,120,632,000 in commercial insurance claims paid alone. If you own a company here, the right coverage is necessary to avoid financial ruin. Mississippi business insurance can include protection for your rental business.

A Mississippi independent insurance agent can help with policy and premium options that are affordable. They do the shopping for you at no additional cost. Connect with a local expert for tailored quotes in minutes.

What Is Rental Business Insurance?

In Mississippi, your rental business insurance will have to account for all exposures. When you rent out equipment or property to others for a living, it's key to have adequate protection. Check out the policy that can get you there.

- Rental business insurance: This will include liability coverage for bodily injury and property damage. Any business property rented to others can be included for replacement and repair in your insurance policies.

What Does Rental Business Insurance Cover in Mississippi?

Every business is different and will need unique coverage specific to its operations. When you own a rental company, there are standard policies you can obtain. Check out the primary policies you can get for your Mississippi rental business.

- General liability insurance: Pays for bodily injury or property damage claims where you and your employees are responsible.

- Business interruption: This will pay for regular business expenses when you are temporarily shut down due to a covered loss.

- Commercial property insurance: Pays for building, equipment, and inventory damage from a covered loss.

- Equipment or property rented to others: Pays to replace or repair the property you have rented to others.

- Crime insurance: Pays for a claim involving forgery, fraud, or theft to your company.

How Much Does Rental Business Insurance Cost in Mississippi?

Your commercial insurance costs will vary depending on several items. Insurance companies will rate your risk by certain criteria. Here are some factors carriers look at to determine your rental business premium.

- Your business address

- How long you've been in business

- Your gross annual sales

- Business property details

- Prior claims

- Your insurance score

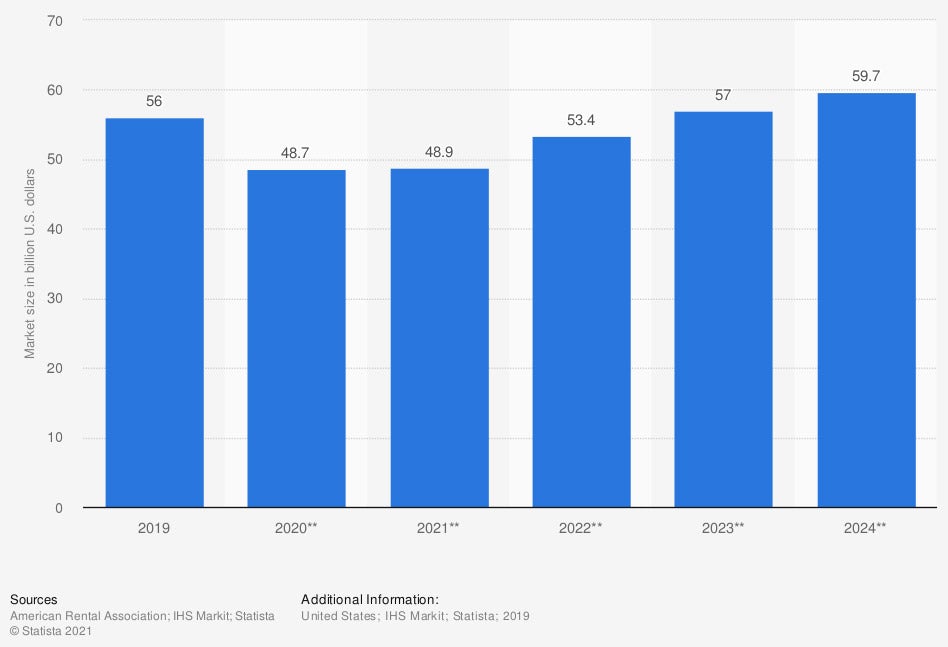

US Equipment Rental Market

If you're in the business of leasing and renting out equipment, it's a big market. To ensure you're fully protected, consult with a professional.

What Does Rental Business Insurance Not Cover in Mississippi?

Mississippi rental business insurance will have coverage for many things. There are some equipment coverages you'll need to add and others that may not apply. Take a look at the common items excluded in your equipment policy.

- Spoilage: This coverage refers to food or items that spoiled due to an equipment loss. It can usually be added for a fee but won't be automatic in most cases.

- Vehicles: Some insureds think automobiles or company vehicles fall under business equipment, but they don't.

- Structures: If you want coverage for any structures or similar, it will fall under your business property coverage.

Does General Liability Insurance Cover Rental Business in Mississippi?

Your Mississippi rental business will need multiple policies to avoid major out-of-pocket losses or worse. General liability coverage will be your primary policy for any business owner. It protects your exposure if a bodily injury or property damage lawsuit arises. Take a look below at what general liability covers.

- General liability: This policy will give you liability coverage for bodily injury, property damage, and libel or slander. Anything else will have to be added in a separate policy.

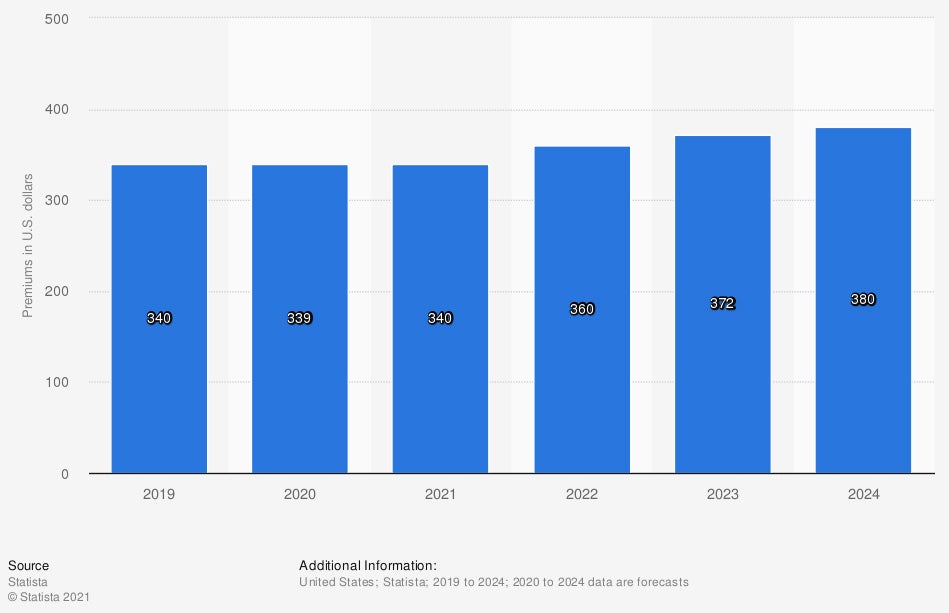

US General Liability Insurance Premiums

The average cost of general liability insurance can vary from entity to entity. A lot will ride on your operations and how proactive your business is. Speak with a trusted agent for quotes.

How a Mississippi Independent Insurance Agent Can Help

If you're searching for the best rental business insurance, consider using a licensed professional. There will be a variety of policies your company can obtain. To make it less confusing and ensure that you're getting all the proper protection, ask for some help.

A Mississippi independent insurance agent has access to several carriers so that you can have options. They do the shopping for free, saving you time and premium dollars. Connect with a local adviser on TrustedChoice,com in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/248725/us-equipment-rental-market-size/

Graphic #2: https://www.statista.com/statistics/1119263/average-cost-b2c-general-liability-insurance-premiums-written-usa/

http://www.city-data.com/city/Mississippi.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.