Mississippi has 257,404 small businesses in existence. As a company owner, you'll need to account for all the what-ifs. Mississippi business insurance can help cover your operations if you're self-employed.

A Mississippi independent insurance agent has a network of carriers to find you the best coverage for an affordable price. They do the shopping for you, saving you time. Connect with a local expert to get started today.

Self-Employed Insurance

When you're self-employed in Mississippi, there are several policy options. To have adequate coverage, you'll need to know what's out there. Take a look at policies that you may want to consider:

- Health insurance

- Disability insurance

- General liability insurance

- Business property insurance

- Commercial auto insurance

- Commercial umbrella insurance

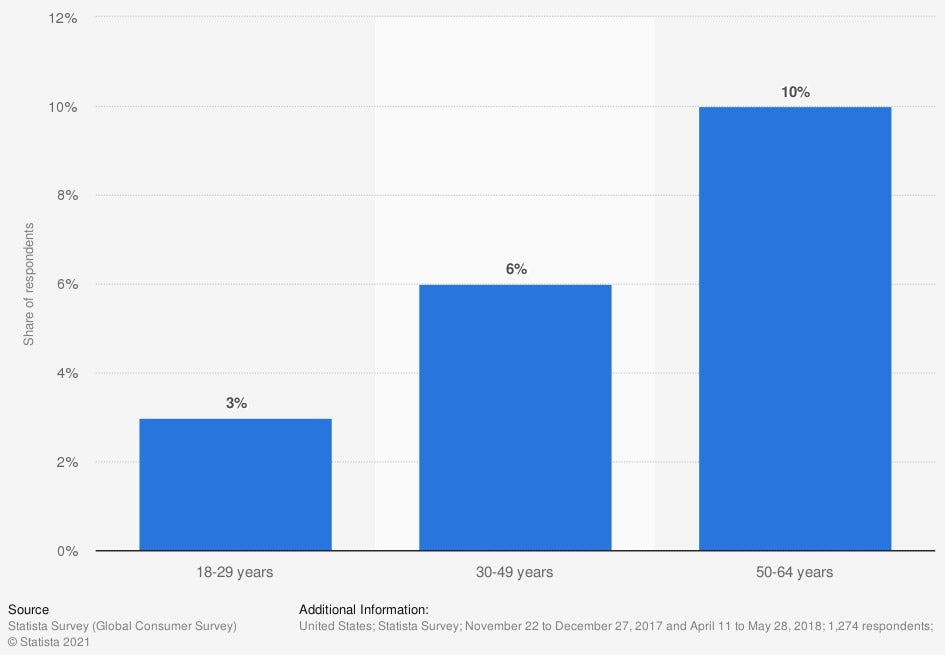

Share of self-employed people in the US in 2018, by age

Self-employment can be a viable option for some people and should be protected carefully. The proper coverage is necessary to avoid financial disaster.

Health Insurance Options for Being Self-Employed in Mississippi

Health care is crucial as a self-employed person in Mississippi. If you have employees, you'll need to think about health insurance for them as well. Since you won't have a boss to provide health care, these options will be available to choose from:

- Private health insurance: This can be obtained through an independent agent and go through some of the well-known carriers. This route can sometimes be pricey, depending on who's included in your plan.

- Medical sharing plan: This is not technically insurance, but works the same way. You will pay a monthly share amount depending on what program you choose. This share will get pooled with the other members' share amounts. When you have a medical loss, you can file a claim, and the plan will reimburse you from the pool.

- The marketplace: This is insurance through the government marketplace. It can be applied for online at your own risk, or through a licensed agent. You will report your annual earnings and then choose from an assigned market at a discount. The less household income you make, the lower your premiums will be.

Best Health Insurance for Being Self-Employed in Mississippi

The best health insurance for your self-employed business is relative. You'll have a few different choices when it comes to coverage. Your company will have to choose which one is right for your operation and the type of protection necessary.

Private health insurance option:

- Most expensive.

- Works well with most healthcare offices.

- May offer the most coverage.

- Uses standard health insurance markets.

Medical sharing plan option:

- Less expensive.

- Has restrictions since it's not insurance.

- Has to be reimbursed when a loss occurs.

- Most healthcare facilities have not heard of it.

The marketplace option:

- Least expensive.

- You have to prove your income each year.

- Works best for low-income households.

- It works well if you have a lot of tax write-offs.

- Uses standard health insurance markets.

- Not all healthcare facilities accept this plan.

Self-Employed Health Insurance Costs in Mississippi

The cost of self-employed health insurance in Mississippi will vary from entity to entity. Carriers will look at which industry you're in and how you operate your business when assigning rates. Take a look at what health insurance companies use to set your premiums:

- Location

- Health history

- Your age

- Your weight

- Any current health concerns

- How often you work out

Disability Insurance for Being Self-Employed

In Mississippi, $3,120,632,000 in commercial insurance claims were paid in 2019. A some of those claims were due to injury, illnesses, and even death. If you're self-employed, you'll want protection for yourself. Check out what disability insurance has to offer:

- Pays for your lost income when a disability occurs.

- Short-term disability will pay 60% to 70% of your income.

- Short-term disability lasts up to a year in some cases.

- Long-term disability will pay 40% to 60% of your income.

- Long-term disability lasts the length of the disability or until retirement.

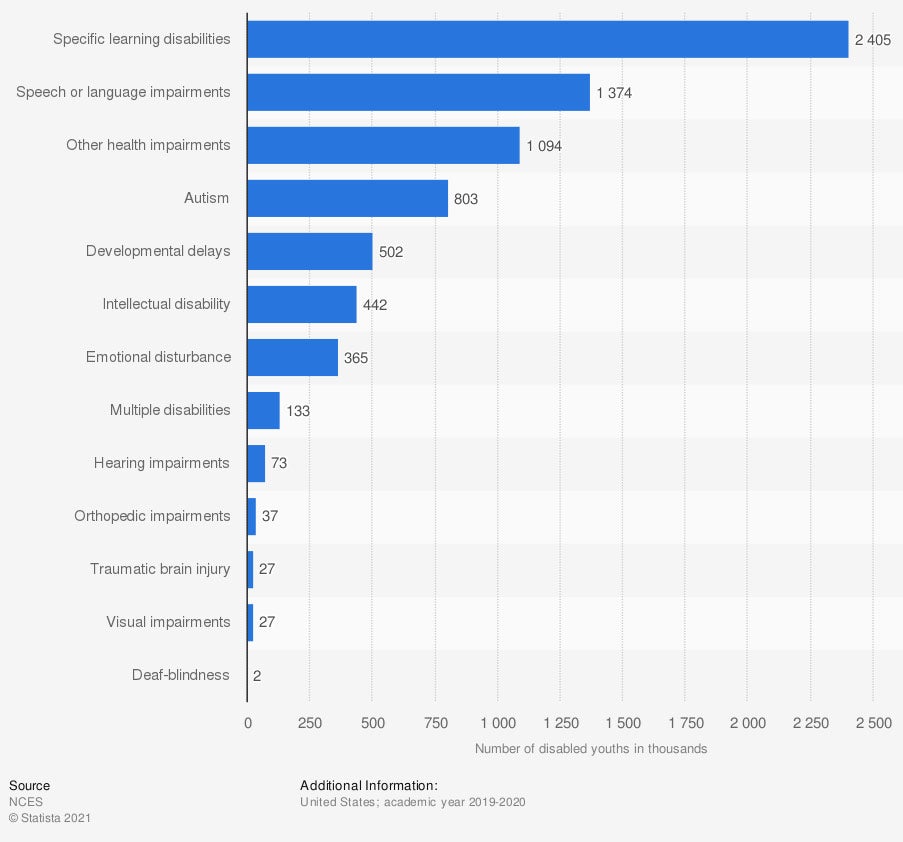

Number of 3- to 21-year-olds served under the Individuals with Disabilities Education Act (in thousands)

Sometimes you are born with disabilities that can affect your work, and at other times, you could become disabled as an adult. As a self-employed person, disability insurance is vital.

Do Self-Employed Workers Need Workers' Compensation Insurance in Mississippi?

In Mississippi, workers' compensation insurance is necessary when you have employees. Sometimes a contract will require you to obtain workers' compensation coverage for yourself. First, it's beneficial to know what workers' compensation is:

- Workers' compensation insurance: Pays for the lost wages and medical expenses of an employee that gets injured or becomes ill while on the job site.

How a Mississippi Independent Agent Can Help

When you're self-employed, there's a lot you'll be responsible for handling. Your Mississippi business insurance doesn't have to be dealt with on your own. Fortunately, a trusted adviser can help review your coverage for free.

A Mississippi independent insurance agent will have access to several markets so that you're presented with the best policy for a fair price. They do the shopping for you at no cost. Connect with a local expert on TrustedChoice for quick quotes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/228346/people-who-are-self-employed-usa/

Graphic #2: https://www.statista.com/statistics/236119/disabled-youths-served-under-idea-us/

http://www.city-data.com/city/Mississippi.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.