In Mississippi, there are 257,404 small businesses in operation. Every company will need industry-specific coverages to have adequate protection. Mississippi business insurance can help insure your soybean farm.

Fortunately, a Mississippi independent insurance agent has access to multiple markets so that you are presented with the best options. They'll compare with their network of carriers, giving you coverage and premiums that are affordable. Connect with a local expert for tailored quotes in minutes.

What Does Soybean Farm Insurance Cover in Mississippi?

Mississippi soybean farm insurance will have a variety of policy options. It may be challenging to know what's necessary for your operation, and protection can be reviewed by an agent. There are standard coverages that every farm will need.

What your cotton farm insurance generally covers:

- General Liability: A general liability policy will provide bodily injury and property damage coverage.

- Commercial property: This policy covers your farm structures, pole barns, and can even insure your equipment.

- Accidents: This can be anything from coverage for electrocution, fire, and smoke, to loading and unloading of livestock.

- Natural disasters: Volcanic eruptions and sinkholes are covered. Typically, floods and earthquakes are covered under a separate policy.

- Weather events: Lightning, wind, hail, tornadoes, and more.

- Crimes and civil unrest: This is for theft and vandalism of livestock.

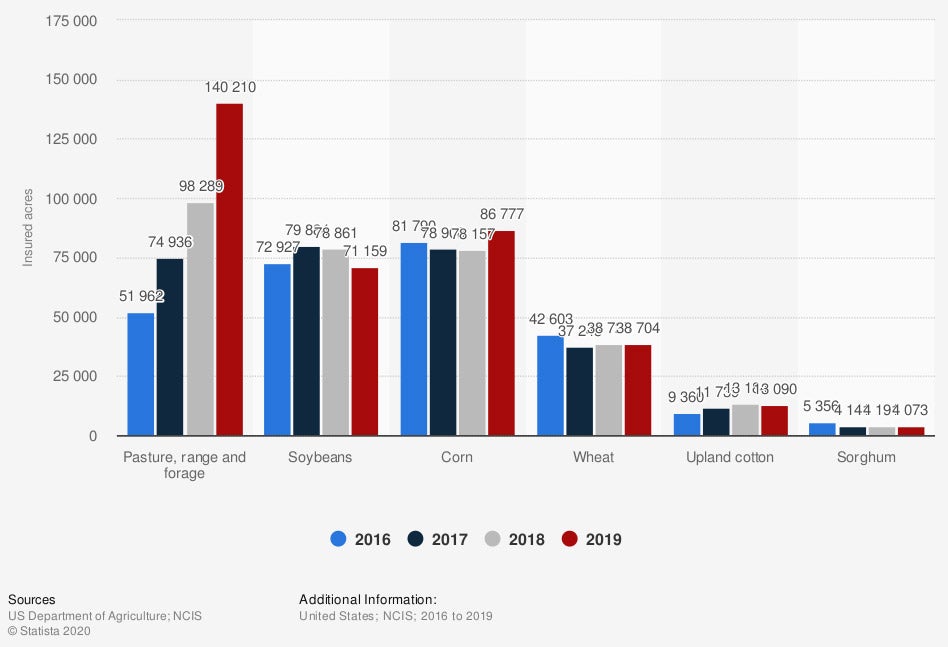

Volume of insured acres of farmland in the US from 2016 to 2019, by crop

When you're looking for proper coverage, you'll need to consider your farm's acreage. Insurance for your crop itself is typically covered under a separate policy.

What Doesn't Soybean Farm Insurance Cover in Mississippi?

All commercial insurance policies come with exclusions. Your soybean farm insurance is no different, and some additional insurance will be required for adequate protection. Coverages that need a separate policy for your soybean farm are as follows:

- Crops: Your farm's crops will be covered under a separate crop policy for any damage.

- Vehicles: Some insureds think automobiles or company vehicles fall under farm equipment, but they don't.

- Structures: If you want coverage for any buildings, it will fall under your farm's property coverage.

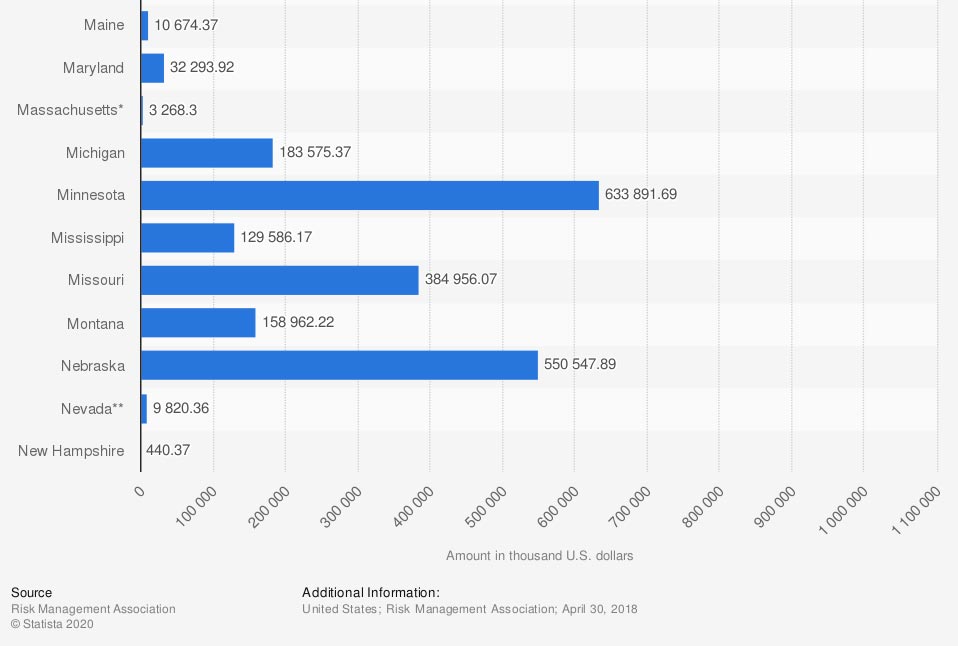

Value of crop insurance premiums in the US, by crop (in million US dollars)

Soybeans are one crop that is commonly insured by carriers. The right policies for your soybean farm can mean the difference between whether a claim is paid by you or the insurance company.

How to Insure Your Soybean Farm in Mississippi

Every business will be insured according to its specifications. When you operate a soybean farm, there are ways to make your protection more comprehensive and well-rounded. Check out some additional coverage options for your soybean farm in Mississippi that you may want to consider:

- Commercial umbrella insurance: This policy can be obtained for additional liability coverage above and beyond your underlying limits.

- Inland marine insurance for farm equipment: This can be added to a farm policy for anyone that uses equipment, tractors, and more for tending to their farm.

- Extended liability limits: You can increase your underlying liability limits for added coverage.

Soybean Farm Insurance Costs in Mississippi

Your Mississippi soybean farm insurance premiums will differ from other farms in the area. This is because carriers will individually calculate your costs based on your unique business. Check out what companies use to rate your soybean farm insurance:

- The value of each piece of equipment

- Your safety measures in place

- Who operates said equipment

- Your claims history

- Your business address

- Local disasters

Common Mississippi natural disasters that can impact your premiums:

- Severe storms and lightning damage

- Burglary and other property crimes

- Hurricanes and tropical storms

- Tornadoes

- Flooding and water damage

How to Connect with an Independent Insurance Agent in Mississippi

If you're searching for the perfect soybean farm insurance policy, consider using a trained adviser. There are numerous coverage options when it comes to insuring your Mississippi farm. Instead of going it alone, have a trusted professional review your policies for free.

A Mississippi independent insurance agent can help you find protection that won't break the bank. Since they have a network of carriers, you'll get the best coverage that fits your budget. Connect with a local expert on TrustedChoice and start saving today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/723015/volume-of-insured-acres-of-farmland-usa-by-crop/

Graphic #2: https://www.statista.com/statistics/723049/value-of-crop-insurance-premiums-usa-by-crop/

http://www.city-data.com/city/Mississippi.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.